Flood Zones and Flood Insurance in and Around Tampa

If you live in Florida, you probably worry about floods from hurricanes and strong storms that could bring river, gulf, and ocean water into your home, but do you actually live in a flood zone? Do you need flood insurance? Our agents at Fearnow Insurance are here to help you determine if you need flood insurance for your property.

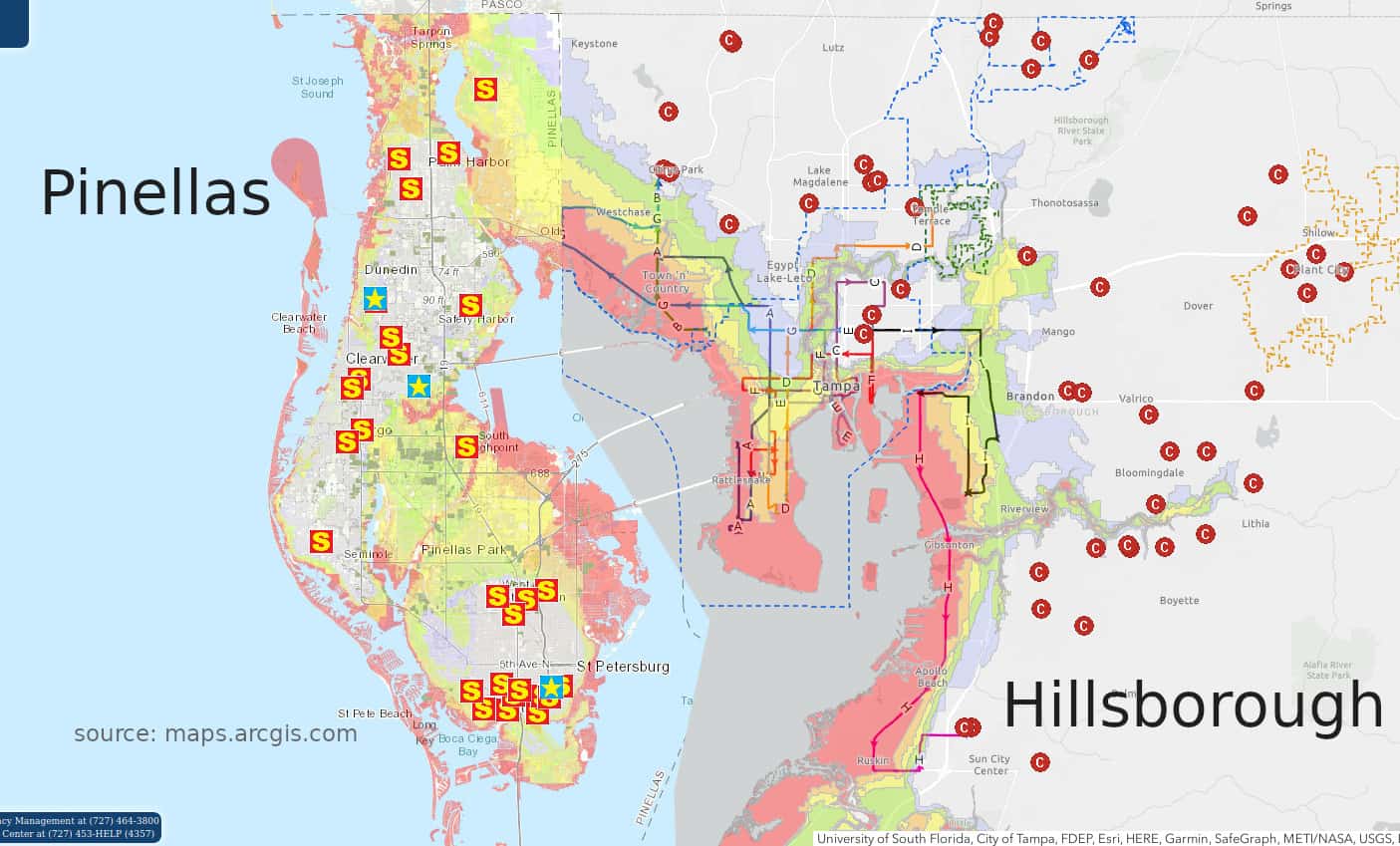

Flood Zones in and Around Tampa, FL

In Hillsborough County and Tampa, Florida, flooding from tropical storms, hurricanes, and severe thunderstorms is a constant concern. Hillsborough County, including Tampa, is in a flood zone with a zone designation of AE. These are flood zones that have a 1 percent annual chance of flooding. In Tampa, the BFE or Base Flood Elevation, is 10 feet according to FEMA. This means that if you live in or around Tampa or anywhere in Hillsborough County, you should have flood insurance.

Hazards of Flooding

Flooding is extremely dangerous to people, pets, homes, and personal property. For example, did you know that as little as six inches of fast-moving flood water can knock over an adult? One foot of floodwater can carry away a compact car, and two feet of floodwater can wash away most other types of vehicles.

When it comes to flood water entering your home, even as little as one inch of flood water can damage carpet, wood structural components, drywall, and your home’s foundation. If this doesn’t sound like a lot of water or damage to you, just think about how much it would cost to have your foundation inspected and repaired. You may also need to replace your subfloor, carpet and carpet pad as well as the bottom six inches of drywall, which has to be cut out and replaced due to the risk of mold.

In addition to damaging the structural components of your home, your home’s electrical system, water pipes, gas pipes, and appliances may also need to be replaced after your home floods. This can result in the need to spend tens of thousands of dollars on repairs. The good news is that flood insurance can help you pay for the repairs and even the entire replacement of your home in the event of a flood.

Understanding Flood Insurance

Flood insurance is a separate policy from a standard homeowners or renters insurance policy. Your homeowners or renters insurance may provide coverage for certain types of water damage, such as a burst pipe or severe thunderstorm damage where the storm compromised your roof and water leaked in from the rain. Renters and homeowners’ policies do not cover damage that is caused by groundwater from overflowing rivers, streams, lakes, and oceans.

Who Needs Flood Insurance

It’s important to note that homeowners who have mortgages that are federally backed and who are in areas that are considered high risk for flooding must have flood insurance. If you don’t have a federally backed mortgage or your home is paid off, flood insurance is not required. However, it’s still a good idea to get flood insurance if you have a home in Hillsborough County, FL.

Understanding the Type of Flood Insurance Policy You Need

Homeowners would most likely benefit from flood insurance that covers both the structures on their property and their personal belongings. Renters would only need a flood insurance policy that covers their personal belongings, and landlords or building owners who rent their properties would only need flood insurance that covers the structures on the property.

Getting Flood Insurance with Fearnow Insurance in Florida

A policy that covers the structures on your property and that covers your personal property, which are the items stored in your home, garage and any outbuildings and cost can vary.

You can get flood insurance for the structures on your property that covers up to $250,000 worth of damage. Personal property flood insurance can be purchased with limits of up to $100,000. If your home or personal property exceeds these limits, you can add to your flood insurance by purchasing an excess flood insurance policy.

For more information on flood insurance and to get a quote, give us a call at (813) 689-8878.