Make Your Voice Heard: Stabilizing and Improving Florida’s Home Insurance Market with Your Help

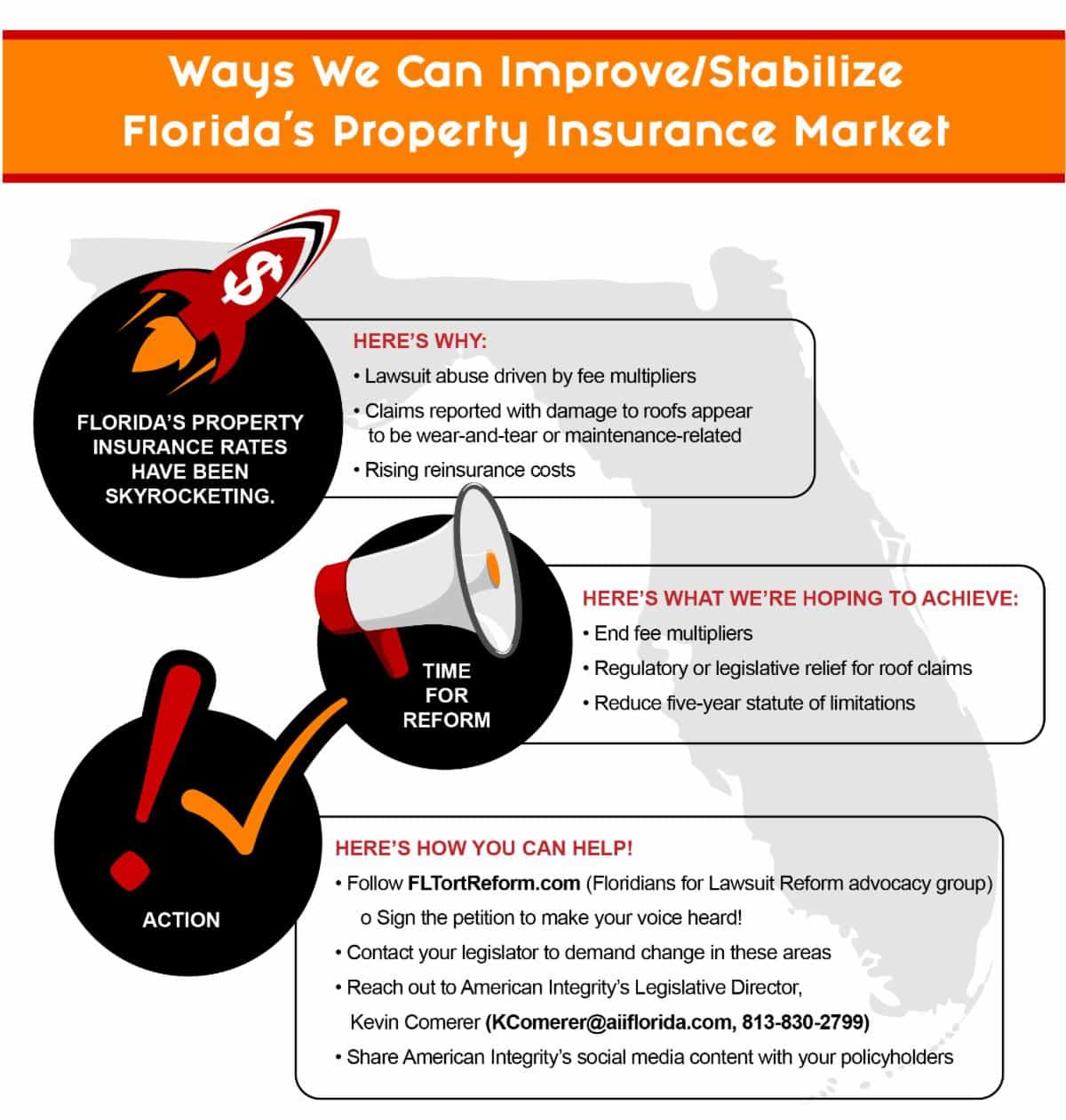

If you’ve lived in Florida for the last several years, you’ve probably noticed an alarming upward trend in your homeowners insurance premiums, even if you haven’t file any claims. The biggest reason for the upward trend in premium amounts is due to fraudulent homeowner’s claims and the need to battle these claims in court with attorneys. The end result is that the fees and any payouts come directly from the homeowners’ pockets in the form of higher monthly premiums. The good news is that you can help us fight these higher premiums by making your voice heard.

The Next Florida Legislative Session

The next Florida Legislative Session starts March 2 and runs through April 30, 2021. This 60 day period can allow you to make your voice heard when it comes to Florida’s high homeowner’s insurance premiums and the reasons for the sustained increases.

Fighting Frivolous Lawsuits and Stopping Home Insurance Premium Hikes with SB 914

Here at Fearnow insurance, we’re certain that you’ve seen the television advertisements for lawyers who state that they can get money for you if you’ve been wronged by your insurance company. These lawyers make six-figures by sometimes filing frivolous lawsuits against insurance companies in the hopes that they’ll win the judgment. If they win, the claimant receives some money from the judgment, but the lawyers involved in the case receive more. The problem with these frivolous lawsuits is that whether or not the insurance company wins or loses, your rates still go up because of the cost of hiring those lawyers to fight the lawsuit. In other words, you’re paying for these lawsuits through higher homeowners insurance premiums, even if you’ve never filed a claim and never hired a lawyer to fight a claim for you.

The good news is that there is legislation in the works that could limit the amount of financial damage these lawsuits create. It’s called SB 914. This legislation includes several key components that could help control the costs of these lawsuits and limit future home insurance premium hikes, including:

- Limits maximum payout fees with the Lodestar Method, which mandates the use of a reasonable hourly rate for the attorney, expected hours worked on the case, and a reasonable hourly rate.

- Removes the ability to add contingency risk or contingency risk multipliers to a court award.

- Eliminates other common fee multipliers in order to ensure that the lawyer fees in these lawsuits are reasonable and fair for the work put into the case.

The goal of this legislation, which was filed by Senator Jeff Brandes, is to help decrease homeowners insurance rates and possibly lower them by decreasing the costs associated with homeowners insurance lawsuits.

How You Can Make Your Voice Heard with It Comes to Homeowners Insurance Premium Hikes

Floridians Lawsuit Reform has created a website and a webpage where you can Take Action against higher homeowners insurance premiums. The red Take Action button will send you to a page where you can enter your Florida address and zip code. Once you enter your information, a list of outreach options will appear. Additionally, you can find your elected officials, look at key Florida legislation, browse the votes, look at elections and view relevant media.

Homeowners Insurance with Fearnow

If you need homeowners insurance or would like to receive a quote for homeowners insurance, contact our agents at Fearnow. We will do our best to find you the lowest available rates. Not to mention, we are monitoring SB 914 and will let you know if the legislation passes.

To get homeowners insurance, give us a call at 813-981-7862.